Answering the Ultimate Question

As painful as market drawdowns are to endure, they afford us crucial opportunities to reassess tenets to our investment process. The ultimate question we currently face is whether the equity market dislocation is an overreaction that presents massive buying opportunities, or whether it’s a sign that we should retreat to the sidelines. We see all signs resoundingly pointing to the former and outline supporting evidence in this piece. We also chart proactive actions that we’ve taken. In the final analysis, the year-to-date equity pricing erosion has disproportionately been administered by valuation multiple erosion, despite a broad array of improvements to underlying fundamentals of our portfolio issuers. We also outline signs of green shoots formation that are exactly the mechanisms that cause equity pricing to eventually converge back to intrinsic value. Historically, these conditions have set stages for highly attractive returns over the medium- to long-term. We believe the current environment is no different.

Diagnosing the Pullback

When we evaluate the 13.4% pullback that we have seen in the S&P 500 Index since January 4th, it’s helpful to look at the different segments of the market to diagnose what has happened to date. The selloff first hit the growth and smaller-sized companies and did so in a disproportionate fashion, with the Russell 1000 Growth Index falling 20.6% and the Russell 2000 Growth Index falling 27.8% since their respective all-time highs in November 2021.

The equity market adage that “bears pounce, bulls grind” acts as a helpful reminder of the speed at which drawdowns can occur relative to upside realization. There’s also tremendous value in retaining historical context, namely how the markets ultimately sort out the source of fear that’s perceived to be unique or unprecedented. We fleshed out some of these themes during two prior major corrections endured back in December 2018 and March 2020, both of which diagnosed our take in the eye of each respective storm. This current bear market among growth and small caps, with subsequent spillover to the S&P 500, is no different. As inflation persisted longer than expected, causing fears to peak in late 2021, the Federal Reserve changed tone at its November meeting, indicating an end to its zero interest rate policy. On November 8, 2021, zero rate hikes were expected to occur by November 2022. Fast forward two months to January 2022, three hikes were quickly priced in, and then to today, the market has now priced in between five and six rate hikes (125-150bps) by November 2023.

Valuation Support & Relative Positioning

We try to balance near-term and long-term perspectives with portfolio construction. Currently, we see a constructive backdrop for equities on this equity market pullback based on recent earnings results and disparate market participants’ efforts to price equities. That is not to say we like all equities equally; we still see pockets of excess present in the market, mainly concentrated in some electric vehicle-related equities and certain, less than scrupulous SPACs that took advantage of the 2021 easy funding cycle.

Earnings results have generally been strong to start the year for many of our Growth Equity positions, even if preceding and subsequent price reactions have been far from supportive. MRVL, NTRA, VC, NOW, TEAM, WDAY, UBER, GOOGL all had particularly strong updates. All saw their major thesis pillars strengthen, supporting our long-term bullish stance around enterprise software deployment, cloud adoption, electrification of the automobile, preventive healthcare applications, and the long-term value created by the transition to digital-based advertising.

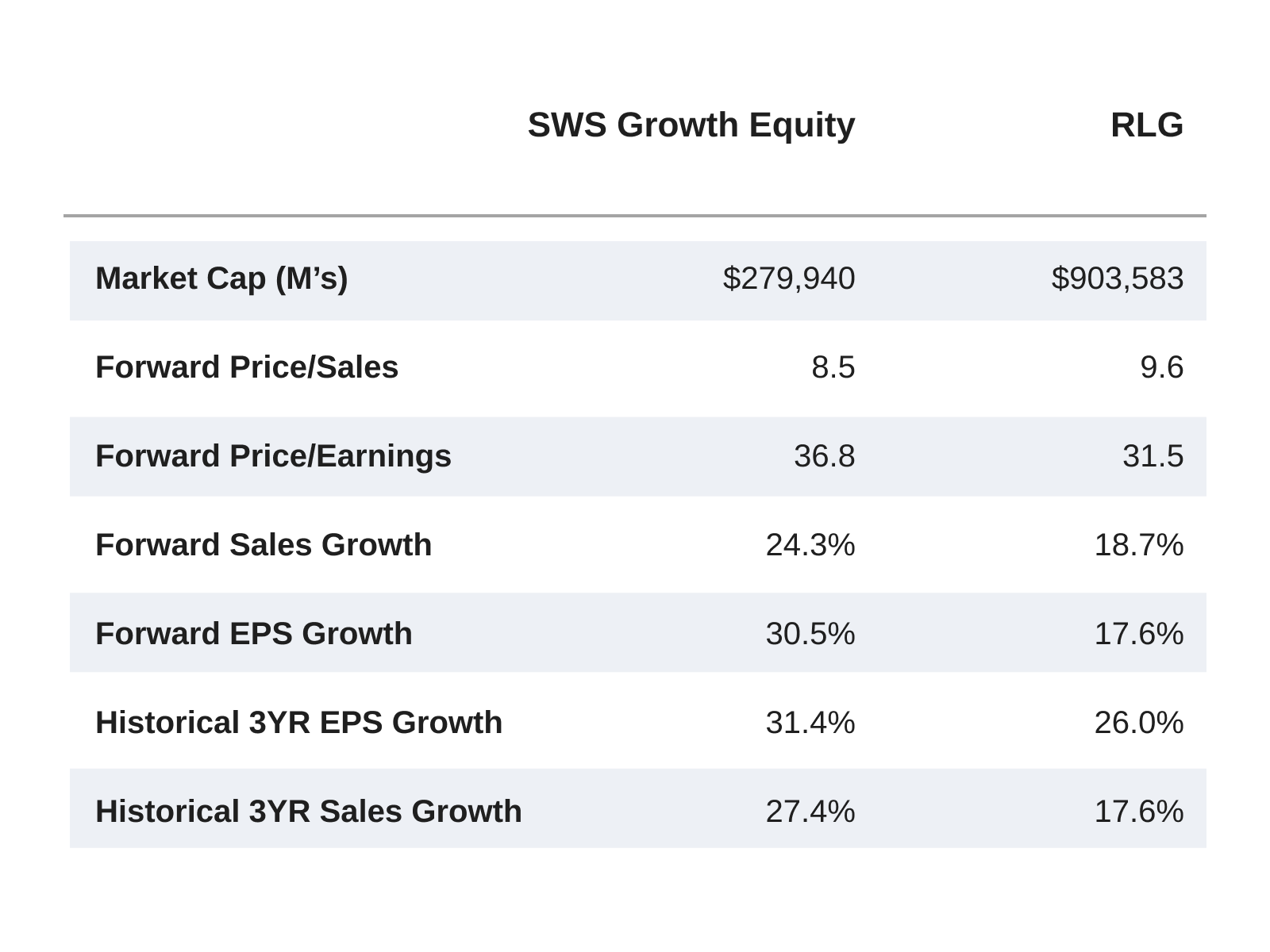

We’re highly focused on equities’ absolute and relative valuation. In the graphic below, we show our current portfolio valuation relative to our stated benchmark, the Russell 1000 Growth Index (RLG). We are currently cheaper than our index on a P/S basis and slightly more expensive on a forward P/E basis, a stance we view as warranted given our higher projected forward sales and earnings growth. We also hold large relative bets against the crowded mega-cap technology companies, evidenced by our weighted market cap of $280 billion versus the Russell 1000 Growth Index at $904 billion, achieved particularly by avoiding Apple (AAPL) and Microsoft (MSFT), a combined 23.5% of the index.

Portfolio Characteristics

Source: FactSet

Equity valuation is part art and part science, and price multiples will vary over time depending on a multitude of factors, including business quality and market environment. However, their underlying fundamental exercise remains consistent regardless of our plot point along the despair-to-euphoria continuum. Valuation is an ultimate attempt to value future cash flows. One particularly salient proofpoint of this can be found in strategic buyers putting actual cash to work and effectively saying, now is the time to deploy capital.

To this specific point, we’ve seen a pick-up in M&A in 2022, with Citrix ($18B), Activision Blizzard ($70B), Zynga ($13B), Cerner ($28B), Mandiant ($6B), and Bungie ($4B) all announced as acquisition targets already this year. Other industry participants, such as company executives, are fading market fears and purchasing shares in their respective companies. This is not an all-inclusive list, but insider purchases at Netflix, Uber, and Natera stood out. Netflix stumbled after its recent earnings print, resulting in a ~50% decline since mid-November. CEO Reed Hastings purchased shares for the first time since 2004. Presumably, he is hypothesizing that 221 million global subscribers and $15.99 per month (US pricing) are not the end-state for Netflix and that its best days are in front of it. Uber CEO, Dara Khosrowshahi, purchased shares for the first time as CEO, as its current market value sits well below its initial May 2019 IPO price of $40. During this almost three-year period of negative absolute and relative market returns, UBER has grown sales by greater than $6B and proven that mobility and food delivery can be profitable. Additionally, it has proven the thesis behind its food delivery business growing from $1.4B in 2019 to a $9.7B annualized run-rate by the end of 2021. Lastly, and most recently, Natera executives took the highly unusual step of forgoing cash compensation for 2022. Instead, choosing to take all compensation in the form of stock, after a ~70% pullback, the last 30% due to a misleading short report (see Position Specific Detail for more information)

Relative Multiple Compression

As public market investors, we don’t take lightly or blindly ignore the macroeconomic or geopolitical reality. But opposite media pundits, our macroeconomic views are highly informed by the microeconomic inputs via close studies of companies that are responsible for generating output that comprises the global economic activity. We focus on investing for the long term through individual positions and let our positional thesis be data-dependent versus allowing price to drive the narrative.

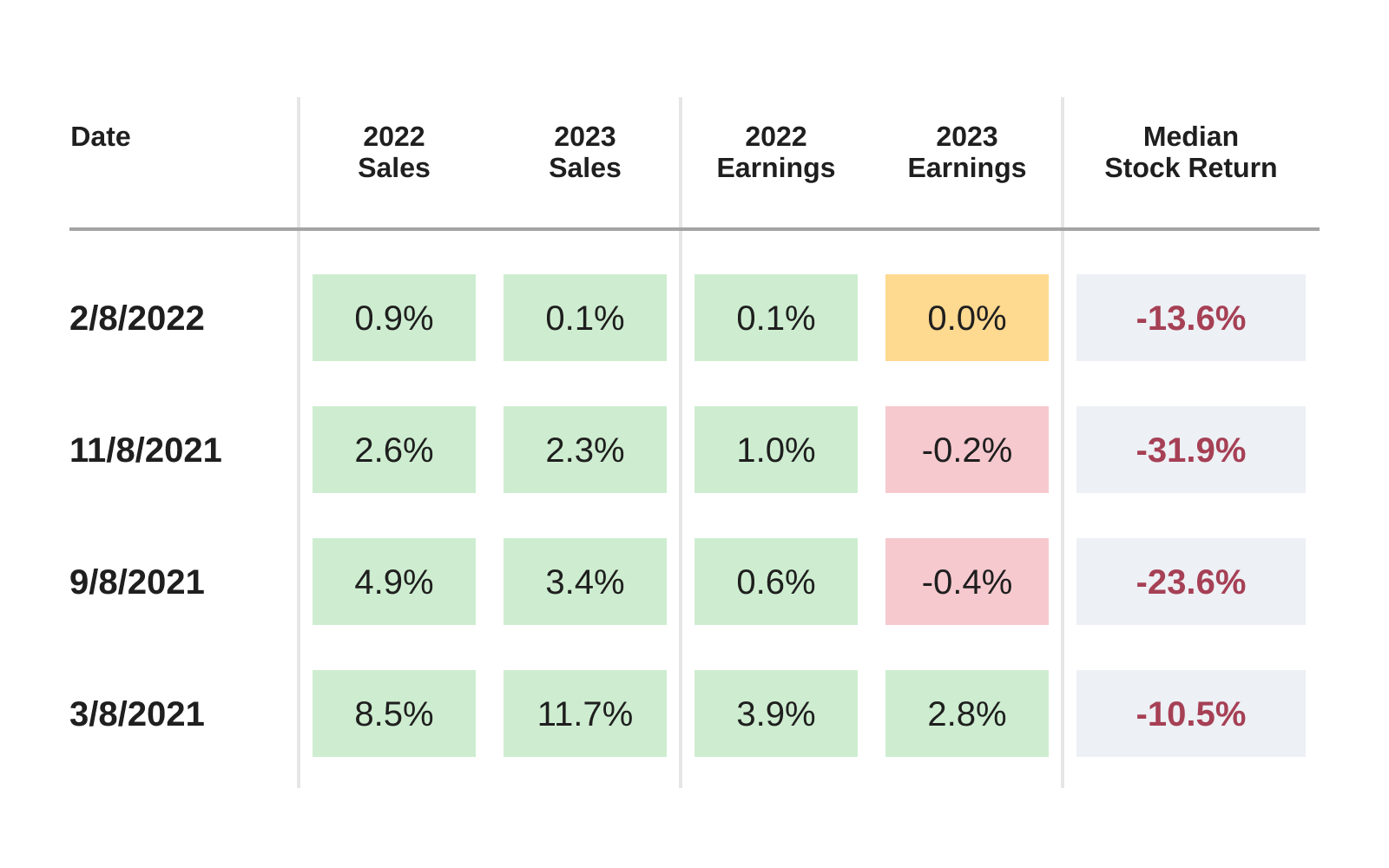

A deeper dive under the hood of our portfolio reveals that price corrections mainly have stemmed from compression in valuation multiple despite improvements in underlying fundamentals of our positions. In the table below, we highlight Growth Equity’s aggregated positions by median levels of sales and earning’s revisions over the past 12 months while juxtapositioning the equivalent time period’s median stock return. We’ve seen strong sales and positive earnings revisions over the past year, with a -11% drawdown and further positive sales/earnings revisions since November 8th, joined by a -32% median stock return.

Growth Equity Position Revisions

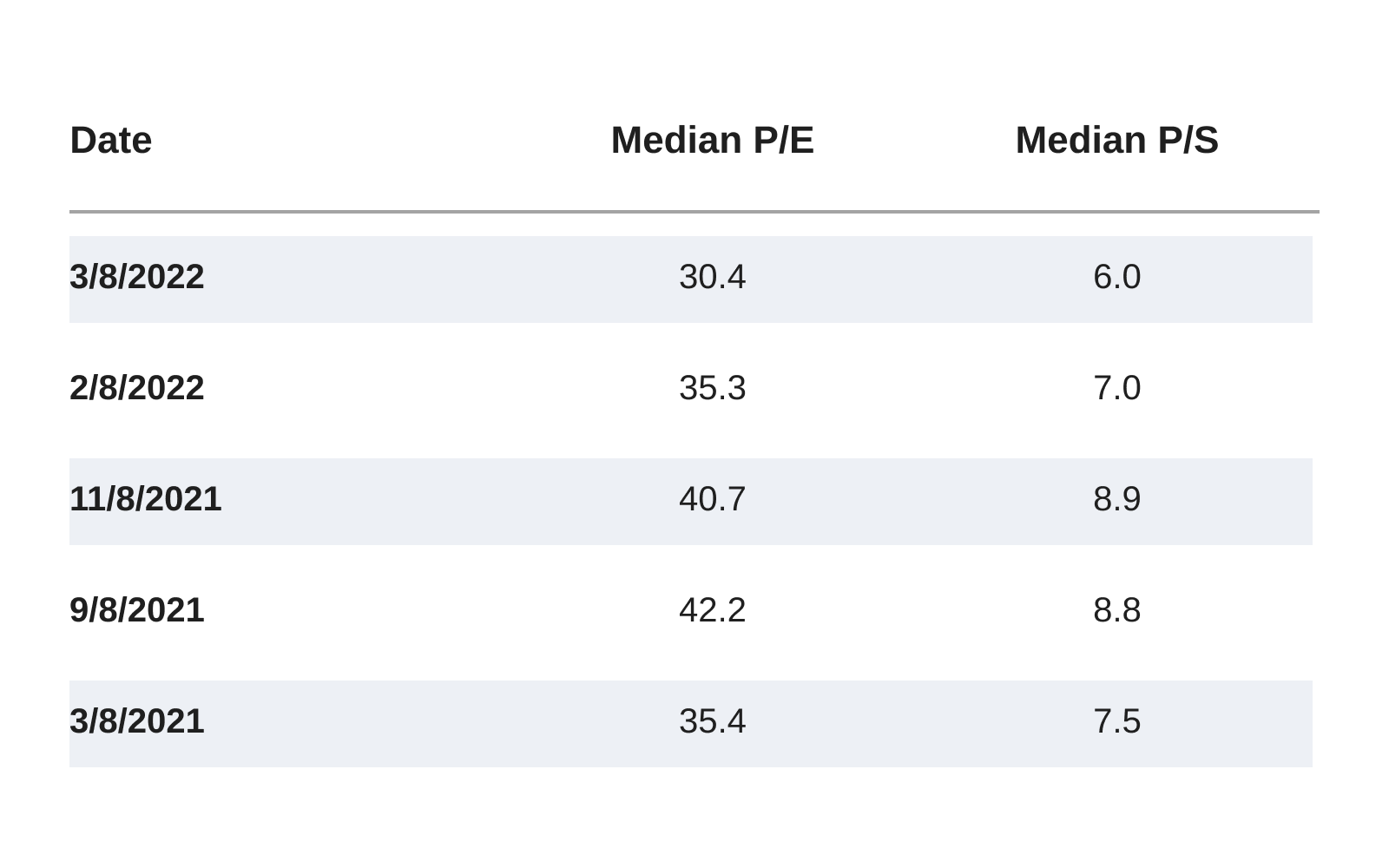

The valuation table further below highlights a 28%/ 32% earnings/sales multiple compression, respectively, since November 8th, showing >100% of the portfolio’s price move has been explained by valuation multiple compression versus fundamental deterioration. This gives us incremental confidence in our positions, as we see stronger odds that the truths of strengthened fundamentals will shine through once the dust of fear settles.

Growth Equity Median Valuations

Position Specific Detail

We know as investors that sometimes narratives can drive price, and with less fundamental investors examining securities, price dislocations can happen more often and at a greater magnitude than ever before. Sometimes an investment thesis can’t be neatly confined to the income statement or earnings revisions, and a more discerning eye is necessary from investors. Just this year, there have been three different instances where news has been released, and we took quick action to purchase shares in companies where the market did not correctly recognize the intrinsic value.

On pullbacks, we acquired more shares of Ambarella (AMBA) at $94, after selling shares at $220 in November, and acquired additional shares of Natera (NTRA) at $34.99. For AMBA, we saw the pullback as highly unwarranted and noted serious progress had been made in infiltrating the automotive industry with their computer vision semiconductor. On the most recent earnings call, CEO Fermi Wang referred to negotiations with multiple customers for 20x their previous high LTV (lifetime value) for a design win, clear evidence that AMBA is materially further along in infiltrating Tier 1 OEMs than previously thought. For NTRA, we took the opportunity to add shares after a highly misleading short report was published, pushing shares down as much as 50% intra-day. This sort of intraday volatility is more typically reserved for SEC charges, not short sellers with questionable intent. Having owned the company for well over a year, had many discussions with management, a thorough understanding of the product, and future roadmap, we were quickly able to factually disprove most of the short report and purchase shares.

On the flip side, we purchased more shares of PureCycle Technologies (PCT) after a positive stock reaction to the updated business plan, albeit the incremental purchase was below our initial purchase of $17 in May 2021. PCT issued a very strong update, including funding for its next two plants with a strategic partner, strong feedstock procurement, and updated offtake arrangements that would sell out of its committed capacity for three plants. This announcement doesn’t affect near-term estimates, as PCT is still pre-revenue until 2023. However, it provides an extremely strong data point that significantly reduces terminal value risk as funding has been secured for the first three plants, and the added strategic partner gives incremental confidence that the recycled polypropylene technology will scale.

Conclusion

The recent geopolitical turmoil with Russia and China has added fuel to the fire of an already nervous pandemic-weary global stock market, as concerns over further escalation and commodity inflation have increased. We see this example as being no different than previous drawdowns: the endpoint never arrives with perfect visibility, and the market bottoms well in advance of the “all-clear” signal. Although we don’t know with perfect certainty how the Russian de-escalation playbook will unfold, we see stronger odds that the global economy will continue to grind out further progress, making current market levels ripe for buying opportunities.

Disclosures:

“Investment advisory services are offered through SWS Partners, LLC (“SWS”). SWS is an investment adviser registered with the Securities & Exchange Commission. Registration as an investment adviser does not imply any particular level of skill or training.”