The following is an excerpt from our SWS Growth Equity quarterly update, our internally-managed strategy based upon an institutionally-designed investment process.

Evidence shows that exposure to the digital enablers is an increasingly critical investment consideration. What was previously a future-proofing exercise has now become a critical pandemic navigation tool. We started to assemble data behind this thesis as they unfolded closer to the eye of the storm back in March/April/May, but the first June-quarter cohorts are echoing the same sentiment: many demand shifts are structural rather than cyclical.

Flight to Safety Digital Enablers

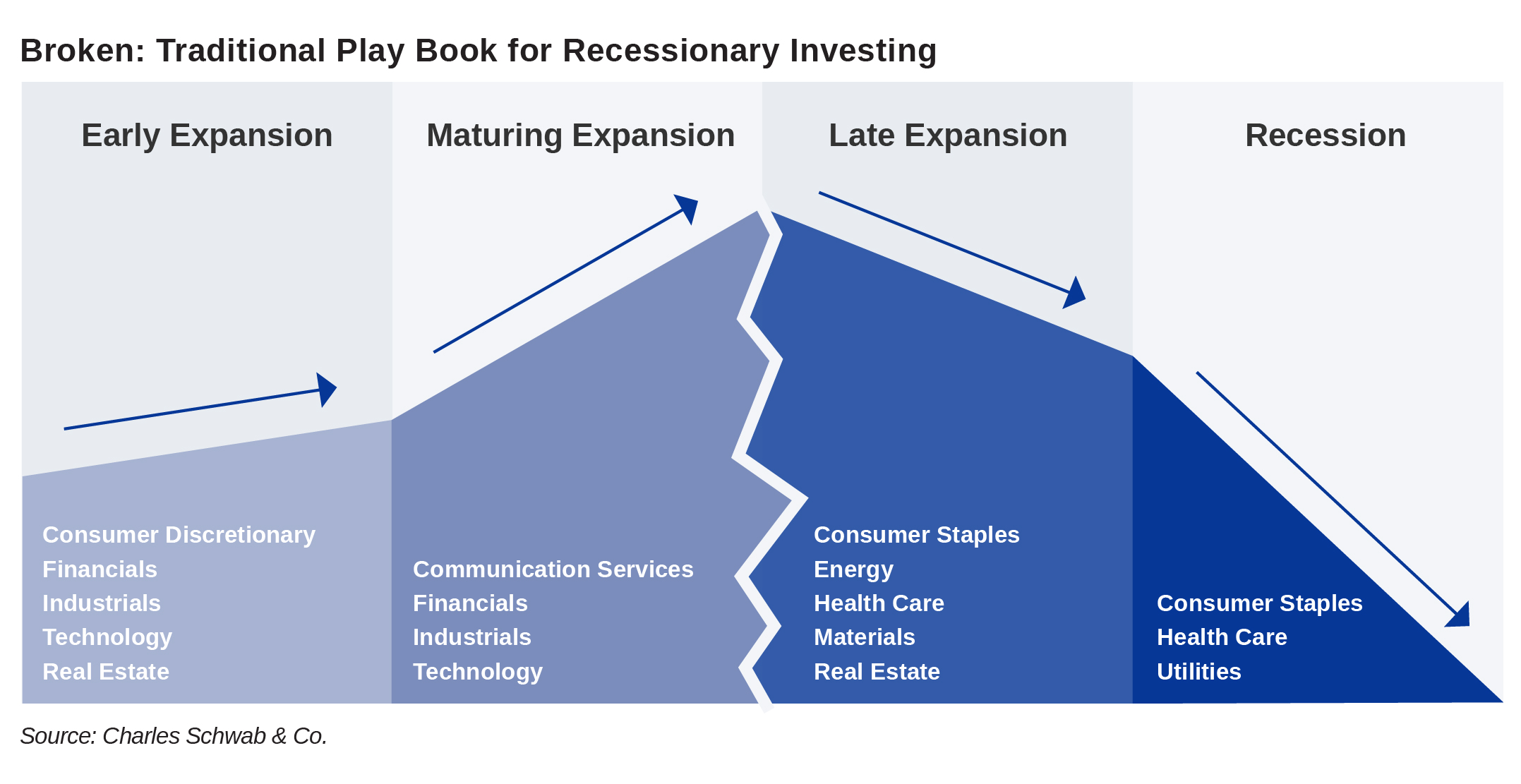

At this point of downdraft recapture—we’ve currently recouped 86% of the high-water’s impairment—we can more definitively assess how traditional early-recession playbooks have fared. The Xs and Os on this whiteboard call for a rotation from tech/consumer discretionary/industrials into utilities/consumer staples/healthcare [see chart below]. This strategy shift is often referred to as a “flight to safety.” However, the nature of our current disruption has blown a crater-sized hole into that playbook: the correct response consistently reinforced is a “flight to digital enablers.”

A Tale of Two Markets

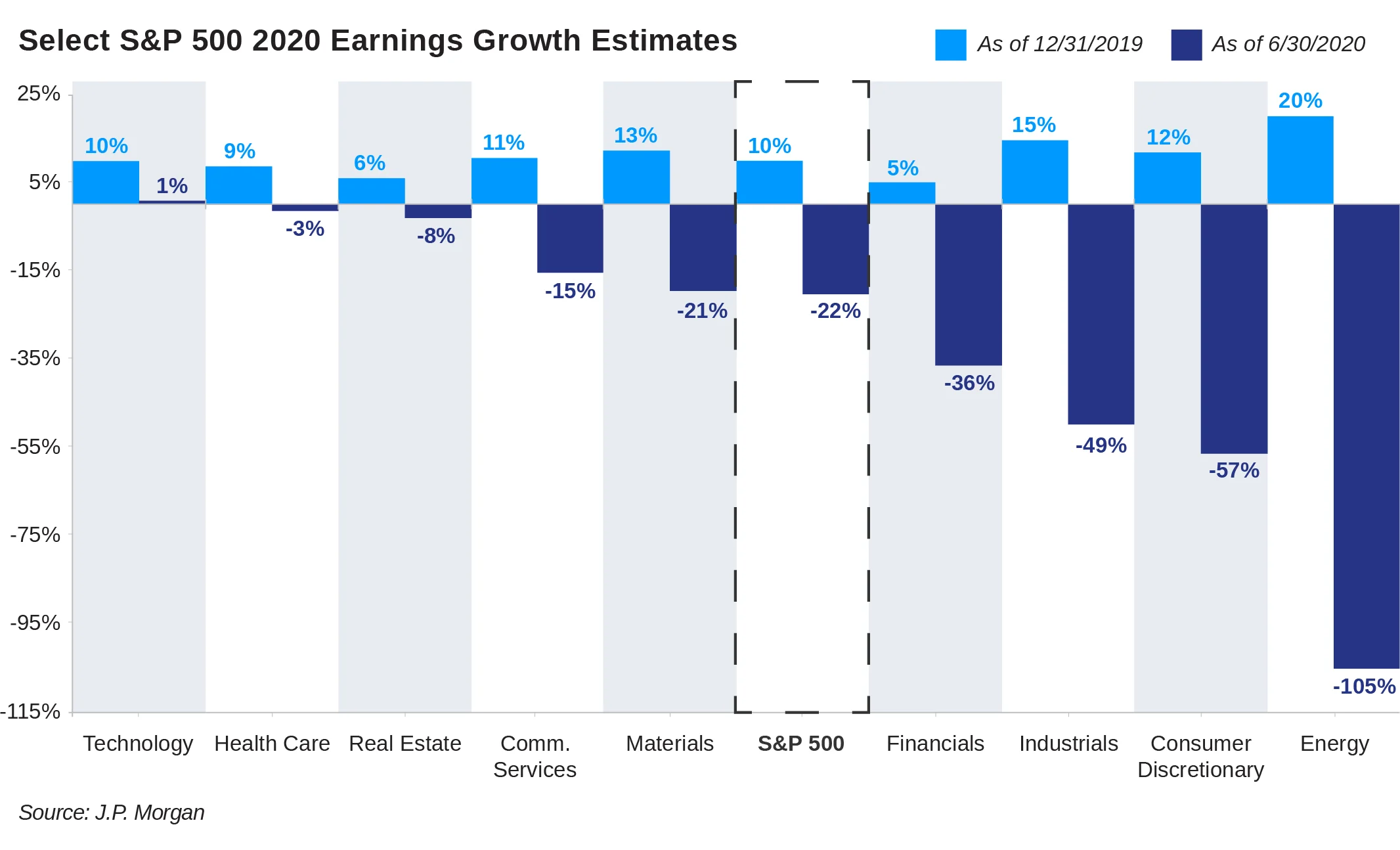

Further dissecting this 86% recapture by the S&P 500, which translates to +0.7% total return on the year, a tale of two markets takes shape: technology and digital enablers versus everything else. As evidence, the NASDAQ Composite and the Russell 1000 Growth sit at +16.5% and +14.4%, respectively YTD, whereas the Russell 1000 Value has languished at -12.9%. These disproportionate impacts map reasonably well upon YTD earnings revisions, suggesting that fundamental justifications may be playing important roles in price disparities.

10 Years of Progress in Eight Weeks

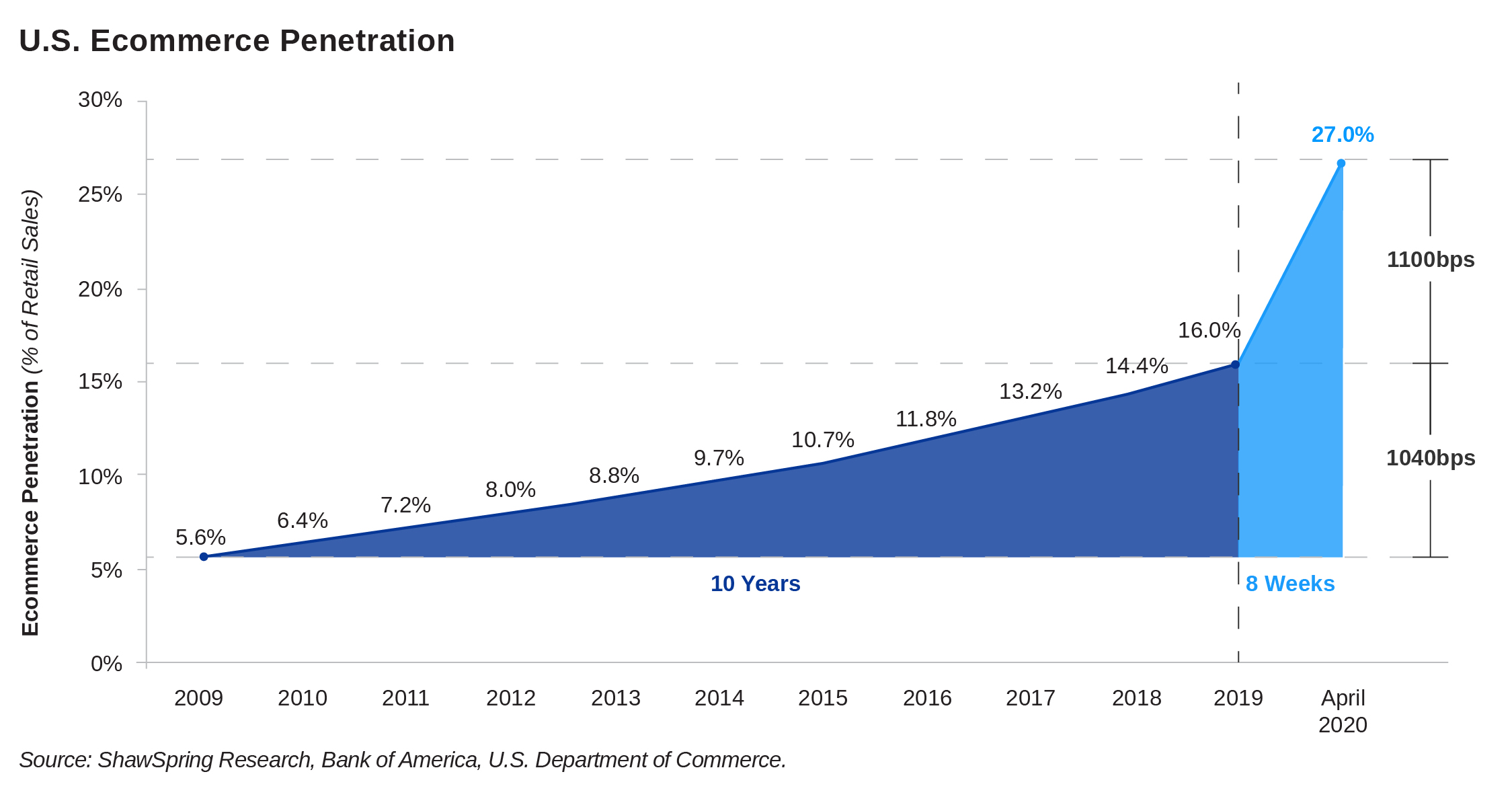

Tools that enabled the rapid digital shifts and ecommerce spending booms brought about by COVID-19 have continued to be leveraged within markets further along in their reopening journeys. One salient example of this dynamic underway was highlighted by Paypal (one of many data points we outlined in a recent piece). CEO Dan Schulman noted that Paypal has not seen any discernible differences after a nation-state reopens, citing elevated levels of ecommerce spend in both Austria and Germany following reopening efforts that occurred earlier than the US. This reconciles with Mastercard’s observations of “card not present” volume—indicative of digitally-sourced transactions—significantly outgrowing “card present” spend, with zero signs of pre-lockdown reversion in the US/globally.

Piecing all of this together, we see the YTD divergence in equity share prices as reasonable. Many consumer and enterprise behavior changes stack up to be more structural in nature rather than cyclical; COVID-19 simply accelerated pre-existing trends. That’s not to say we don’t expect pre-pandemic activities to resume, i.e. going to retail or restaurant establishments and working from an office in some capacity. There simply were greater forces in motion prior to the catalyzing event of the pandemic. The above chart shows the steady course of ecommerce’s cannibalization of brick and mortar, which started long before 2020. We continue to see many other digital-enablement trends following suit in lock-step, such as food delivery and digital wallets, all of which represent important active risk considerations for our managed strategies.

A Mandate to Innovate

Evaluating these data points, through the context of portfolio construction, reveals tremendous upside capture opportunities across various sectors. Disruptions of this speed and magnitude were traditionally confined to tech and biotech investing. However, disruptive innovation is now a front-burner issue facing every company, both publicly traded and privately held. The pandemic has been the catalyst to accelerate many secular themes, but several opportunities are nascent with long runways for growth and alpha creation. Our investment process is designed to challenge and stress-test these opportunities constantly via the assessment of all new data. The output of those efforts continue to reveal attractive opportunities in the addressable public equity opportunity set.

To receive a copy of our entire SWS Growth Equity quarterly update, please contact us.