Our institutional management approach and portfolio due diligence extract actionable insights—and that benefits our clients. For example, in our latest DGO quarterly update, we explored how those calling for a long-overdue market correction are incorrectly pointing the finger at public equities and overlooking one unraveling along the perimeter. Perhaps large private companies who have recently gone public, or those eyeing public share issuance, may be the more likely victims on the chopping block.

Mike Parker outside of the WeWork coworking space in Detroit, Michigan.

Mike Parker outside of the WeWork coworking space in Detroit, Michigan.

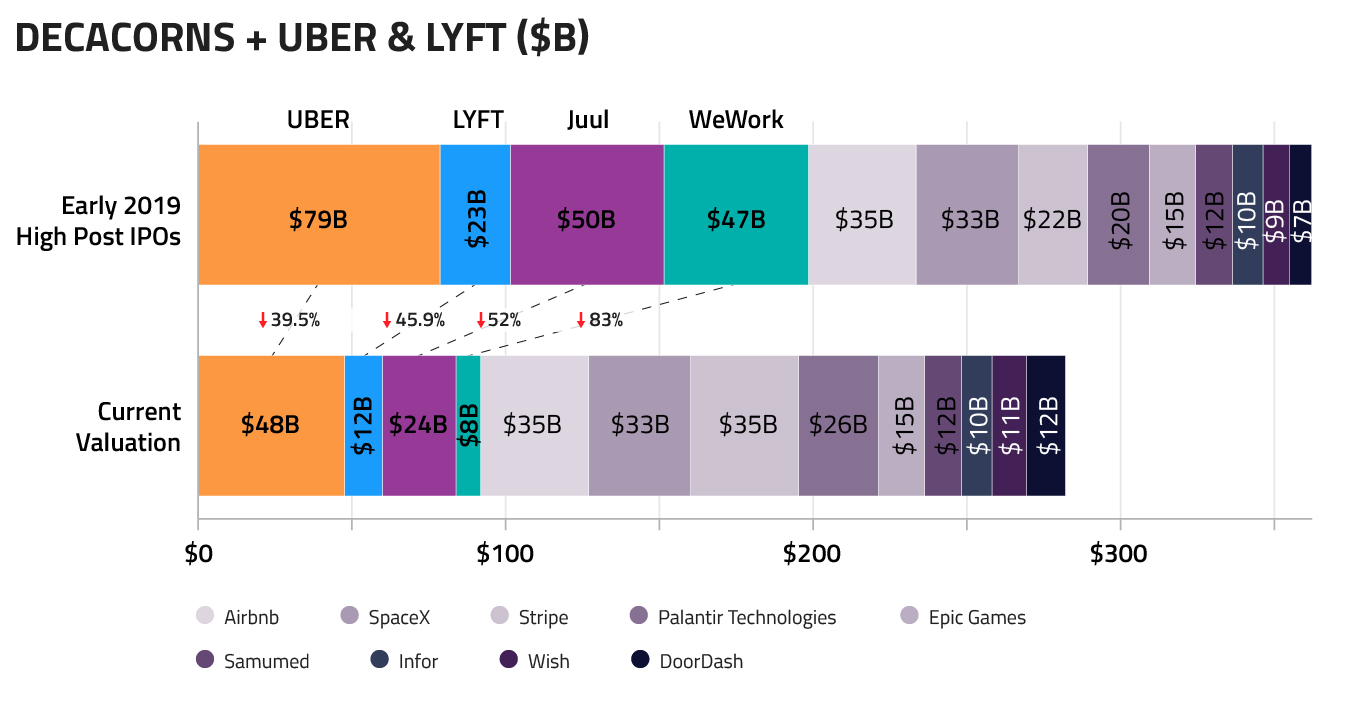

There is no shortage of news-flow surrounding the drama at the well-known large private companies. The issues plaguing some of these “decacorns”—i.e. unicorns with valuations over $10 billion—have the appearance of being isolated. However, taking a step back reveals a meaningful valuation impairment among the group.

At the beginning of 2019, the decacorn cohort with a total valuation of $362 billion rivaled the individual sizes of J&J, Walmart, or JPMorgan. Then WeWork’s IPO gets shelved and management shakeup ensues. Juul’s CEO steps down amidst product safety concerns. Uber and Lyft go public followed by escalating cash burn concerns. This group’s valuation continues to slide, even since publishing our quarterly. The cohort’s total valuation is now 22% lower at $282 billion (see chart 1).

Chart 1 Source: WSJ, CNBC, Forbes, San Francisco Chronicle, FactSet.

Source: WSJ, CNBC, Forbes, San Francisco Chronicle, FactSet.

This has undoubtedly increased scrutiny for all private companies hoping to follow suit in 2020. Naturally, the next question is whether the contagion is likely to spread to public markets—beyond what has already impacted LYFT and UBER.

We explore why we believe this is not the case in our DGO quarterly. Please contact us for a copy.

In reality, these inflated decacorn valuations come from a decade of cheap financing that allowed venture funding sources to be larger and more patient, facilitating sizable later-stage rounds. The downside is a smaller pool of eyes scrutinizing the private ownership stage, meaning corporate governance warts are overlooked and management hubris inflates. This is compounded by multinational firms and sovereign entities with the questionable desire to write large, late-stage checks—in two rounds of $100 billion each—but then later devise a strategy to deploy them. This is precisely SoftBank’s predicament with WeWork.

Investor nervousness of a pricey market is understandable. Being barraged with headlines and presidential tweets of “record highs,” coinciding with titles like “longest bull-run in history,” naturally causes a reemergence of fearmongers. Fortunately, we see that conditions are riper for a correction among the decacorns, which a smaller investor pool owns relative to the larger, more liquid public markets.

The silver lining is the return of rational behavior that’s required to keep bubble formations at bay. As such, we continue to see the public markets positioned to grind steadily higher. The Fed’s latest outlook echoes this by highlighting an intact US consumer, along with stability in job creation and unemployment.

For those whose anxiety fails to subside due to the public equity bull market’s duration, we suggest a meaningful correction via the 20% peak-to-trough pullback during Oct-Dec of 2018 provides reasonable reassurance that the market has more room to run.