The following is an excerpt from our recently published second quarter update for our Dynamic Growth Opportunities Strategy.

In it, we detail the contributors and detractors to the portfolio’s performance, the macro inputs that frame our view of a favorable backdrop for mindful risk allocation, and our belief that the environment is ripe for being able to discern relative winners from losers in the equity market.

To receive a copy of our entire SWS Growth Equity quarterly update, please contact us.

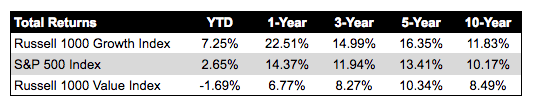

Despite some market choppiness and erosion of gains achieved in mid-June, the growth equity style has continued to outpace both the broad market and the value style. Zooming out to periods that pre-date our strategy’s inception, we see a similar pattern in the longer-term results, for reasons we explore in our latest white paper here. Given the rolling nature of a ten-year snapshot, these longer-term figures are undergoing dramatic modifications as the financial crisis falls off; for magnitude context, the S&P saw a 52.6% peak-to-trough draw-down over the 12-month period ending March 2009:

Source: FactSet. Annualized compound returns shown for periods greater than one year.

Source: FactSet. Annualized compound returns shown for periods greater than one year.

Raison D’être: Alpha Delivery

DGO’s premise of being designed in an attempt to outperform its benchmark is intended to be a longer-term goal, namely a 3-year+ target. That being said, months compound into quarters, which compound into years, and ultimately comprise decades. Thus, we note that success out of the May 1st gate is promising, and subsequent periods may very well experience ebbs-and-flows as the opportunity set evolves with natural market dynamics. Our goal is to assess constantly how those dynamics impact companies’ ability to create value for their shareholders. As such, we highlight the top contributors and detractors to our strategy’s performance for the inception-to-date period (stock price change over this period cited):

Contributors:

Wayfair, Inc. Class A [W]: +82.2%

We hold a long position in Wayfair in the context of the consumer discretionary sector, namely in favor of many brick-and-mortar retailers. As DGO was in incubation mode…

To receive a copy of our entire SWS Growth Equity quarterly update, please contact us.