As we continue to emerge from the pandemic we are again provided with an opportunity to revisit existing ideas in a new and fresh way. The most recent stress test of the economy, markets, and ourselves delivered by the pandemic of the past 15 months shouldn’t be wasted, particularly when it comes to equity investing.

For a number of years now investors have been told that they can’t outperform the market and that their best outcome is to match the performance of the market by using index funds or exchange traded funds (ETFs). A result of this thinking calendar year 2019 was the watershed moment when total dollars invested in these passive investments eclipsed that of actively managed portfolios. This circumstance combined with our virus-induced stress test has provided us an opportunity to briefly revisit the impact of passive versus active investing.

Two terms that you’ve probably heard thrown around by television talking heads and portfolio managers are alpha and beta. Simply put, beta is market based return or the return you can expect from your index. For example, if you buy an ETF that follows the S&P 500, say the SPDR S&P 500, then you should expect to match the performance of the S&P, up or down. Alpha on the other hand is the additional return an investor experiences above the return of the index. Alpha is important because the percentage of investment outperformance above an index can lead to significant compounded gains over the returns provided by the index.

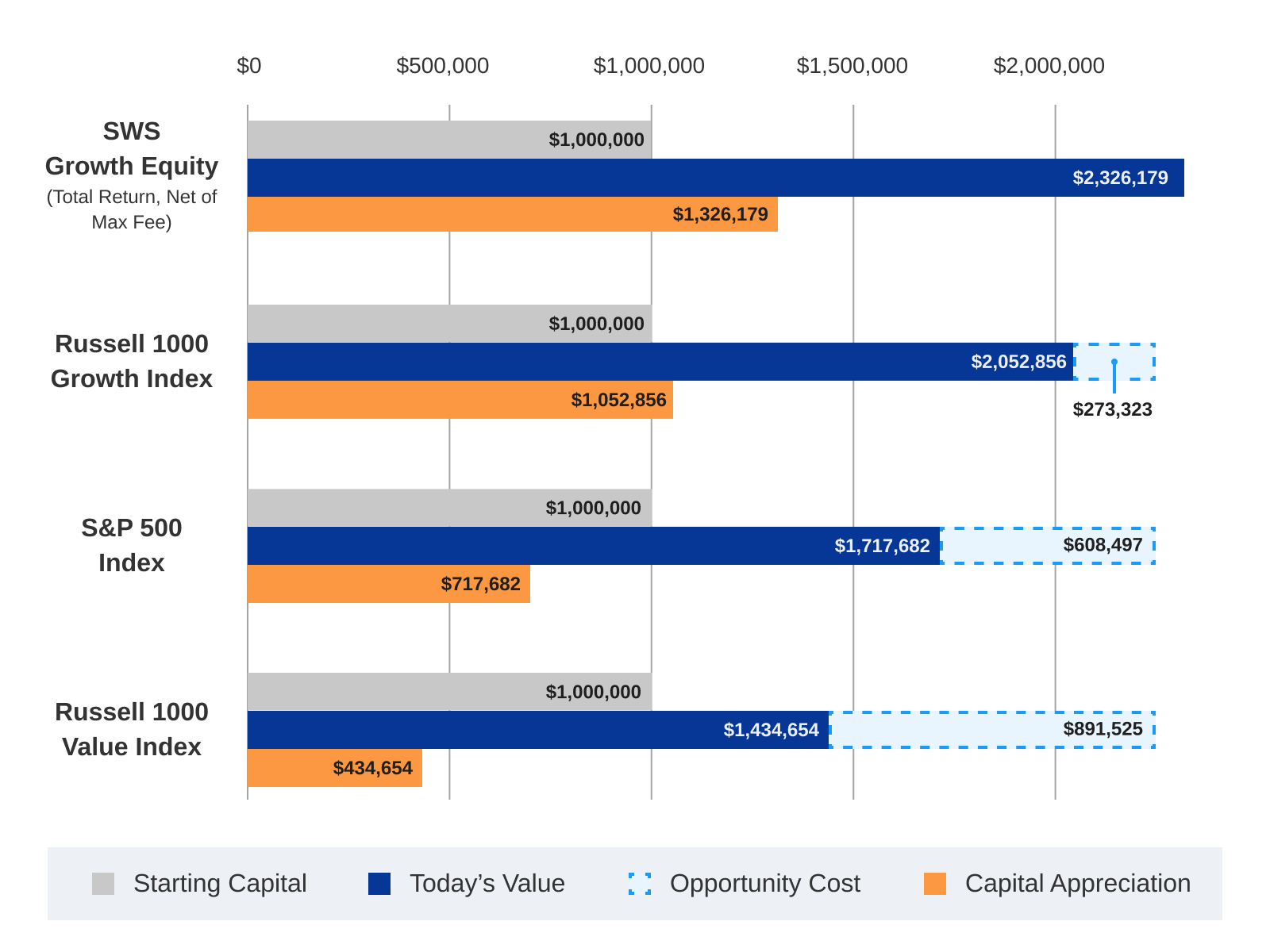

Figure 1: SWS Growth Equity vs Major Indices

(Since Inception: 5/1/2018 – 6/30/2021)

Source: FactSet, Charles Schwab, SWS Partners. Please see important disclosures.

For example, the chart above shows the impact of ~12% of annualized alpha provided by the SWS Partners Growth Equity portfolio over the return of the S&P 500 since our May 1, 2018 inception. While this is only one example, given the market volatility over that time period it is instructive in showing the impact of alpha on a portfolio. As you can see in the blue column, if you invested $1 million in the S&P 500 on May 1, 2018 by June 30, 2021 your account would be worth $1.72 million. However, if you were to have added the ~12% of additional return over and above that of the S&P during that time period your account would have been worth $2.33 million.

In no way do we believe indexing as an investment strategy is a bad idea. We’re simply using this opportunity to point out the outsized impact of alpha on one’s portfolio. If you have any questions or would like a deeper dive into our views on portfolio construction don’t hesitate to give us a call.

Please read these IMPORTANT DISCLOSURES.