The following is an excerpt from our recently published Q3 Dynamic Growth Opportunities (DGO) Update. For a copy of the full document, please contact us.

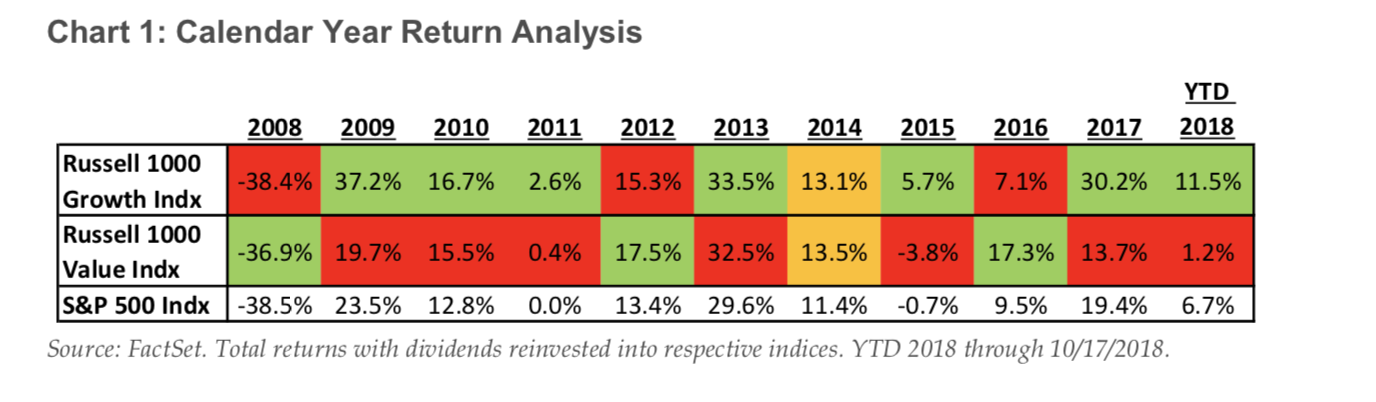

Taking our customary snapshot of 3Q2018’s performance landscape across equity styles, we saw a continuation from the prior quarter, which itself echoed last year’s outcome of growth besting value. In fact, the prior decade has seen such an occurrence six times when analyzing calendar years, with a seventh of near parity (CY2014, see chart 1 below).

October’s drawdown has indeed narrowed the spread for the year-to-date period but the outcome is shaping up in a similar fashion. Rather than proclaim October is a sign we’re amid a sea change of value taking over in multi-year dominance, we continue to believe that a sustainable underlying shift is underway. At the core of this is the commercialization of disruptive technologies, specifically those that enable companies to take share from their incumbents that are either investing down the wrong paths or reluctant to embrace innovation altogether. Such makes for lucrative opportunities to extract relative performance as passive indices average the results of both winners and losers.

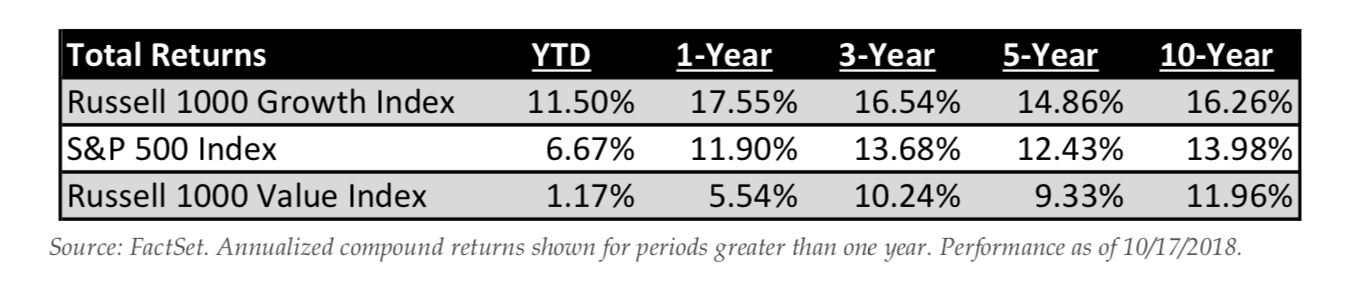

Although periods occur where sustained outperformance retrenches, such as the 8.5% peak-to-trough drawdown experienced in the Russell 1000 Growth Index in October, we believe the course likely to fare best over the next few years is to continue with mindful risk allocation across our growth style opportunity sets. The alternative of becoming more defensive with a shift towards a value-oriented style would be akin to hoping for mean reversion that is unlikely to persist. Such a conclusion appears to be supported in a longer -term comparative return analysis. As we look back over the prior decade, we see annualized averages begin to roll off the worst of the ‘08/’09 financial crisis’ drawdown.

Raison D’être: Alpha Delivery

As a strategy with aspirations to outperform over the long-run, i.e. 3+ years out, we pay close attention to the shorter duration scoreboard but know that this is an exercise prone to fluctuations. A fully-invested portfolio with broad sector exposure as DGO is, our strategy will be prone to fluctuations where price deviates from value…

To receive a copy of our entire SWS Growth Equity quarterly update, please contact us.