The following is another excerpt from our recently published Q3 Market Update. For a copy of the full document, please contact us.

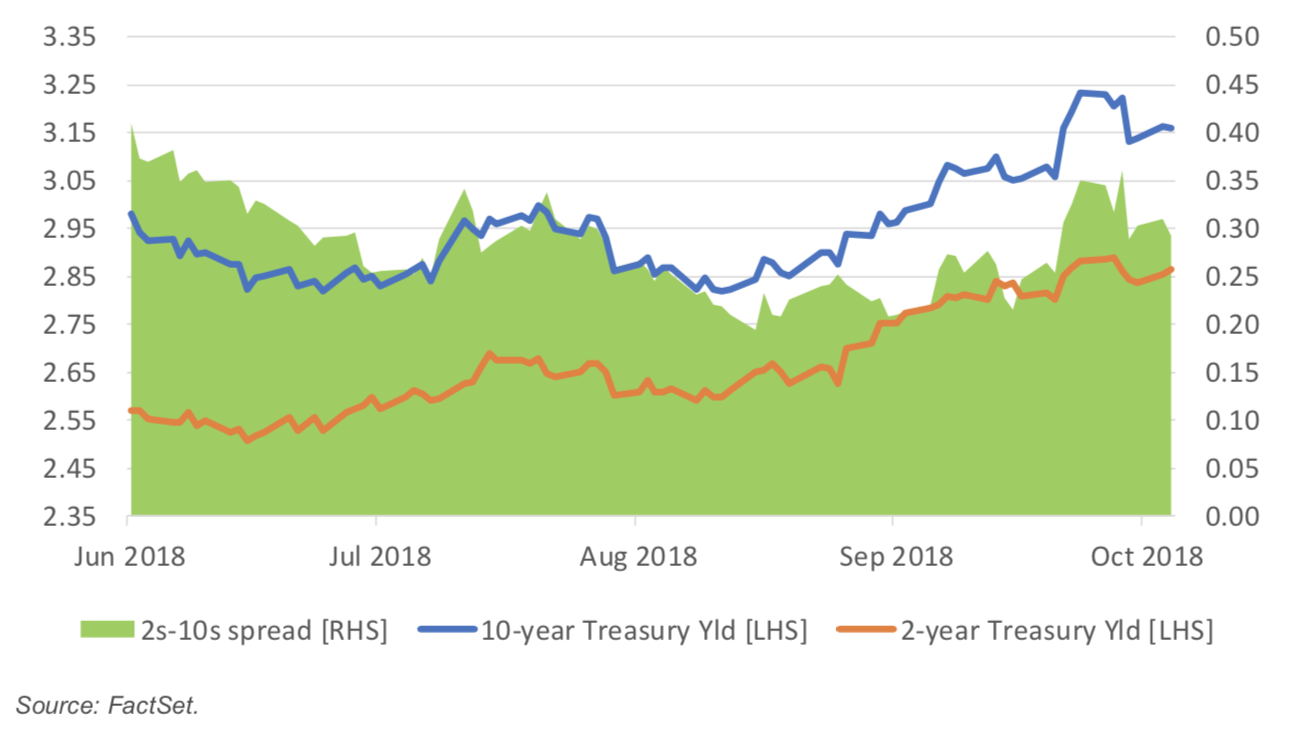

The Federal Reserve’s impact on the short end of the yield curve largely has gone as planned, with the exception of Sep 27’s hike abandoning “accommodative” rhetoric used by the Fed in prior statements. This later spooked investors over concern that the market might not be able to sustain itself without Fed support. However, the rising rate occurrence directly contradicts a large concern from earlier this year over a flattening or even inverted yield curve, an effect that typically acts as the canary to major market downturns. Over the past few weeks, we’ve actually seen 2-10 year spreads widen to 36 bps off their narrowest gap of 19 bps at the end of August. This, of course, has caused the cycle correction harbingers to shift their focus from sounding the flattening alarm to now an unsustainable rise to 10-year yields, peppered with a healthy dose of inflationary cautions.

US 2- and 10-year Treasury Yields

There will always be an economic factor to pluck from the menu of options to support two diametrically opposed viewpoints at any given point in time. We just see the bullish factors outweighing the bearish presently. Although events can and do occur that are truly unprecedented, e.g. a central bank that builds its balance sheet from $900 billion to $4.5 trillion over 6.5 years, there are other economic transitions that have clearer precedent, such as the current rising rate environment. Over the short run, volatility can occur as investors sift through history books of how to navigate, but ultimately amnesia gives way to clarity on how to appropriately prevail in the new norm.

Such a case can be made for rising rates. Now that the financial crisis is further in our rearview mirrors, non-zero deposit rates seem like a distant memory. The implications of this are also something that requires a dusting of mental cobwebs, given the last sustainable period of rate increases began 14 years ago.

To receive a copy of our entire SWS Growth Equity quarterly update, please contact us.