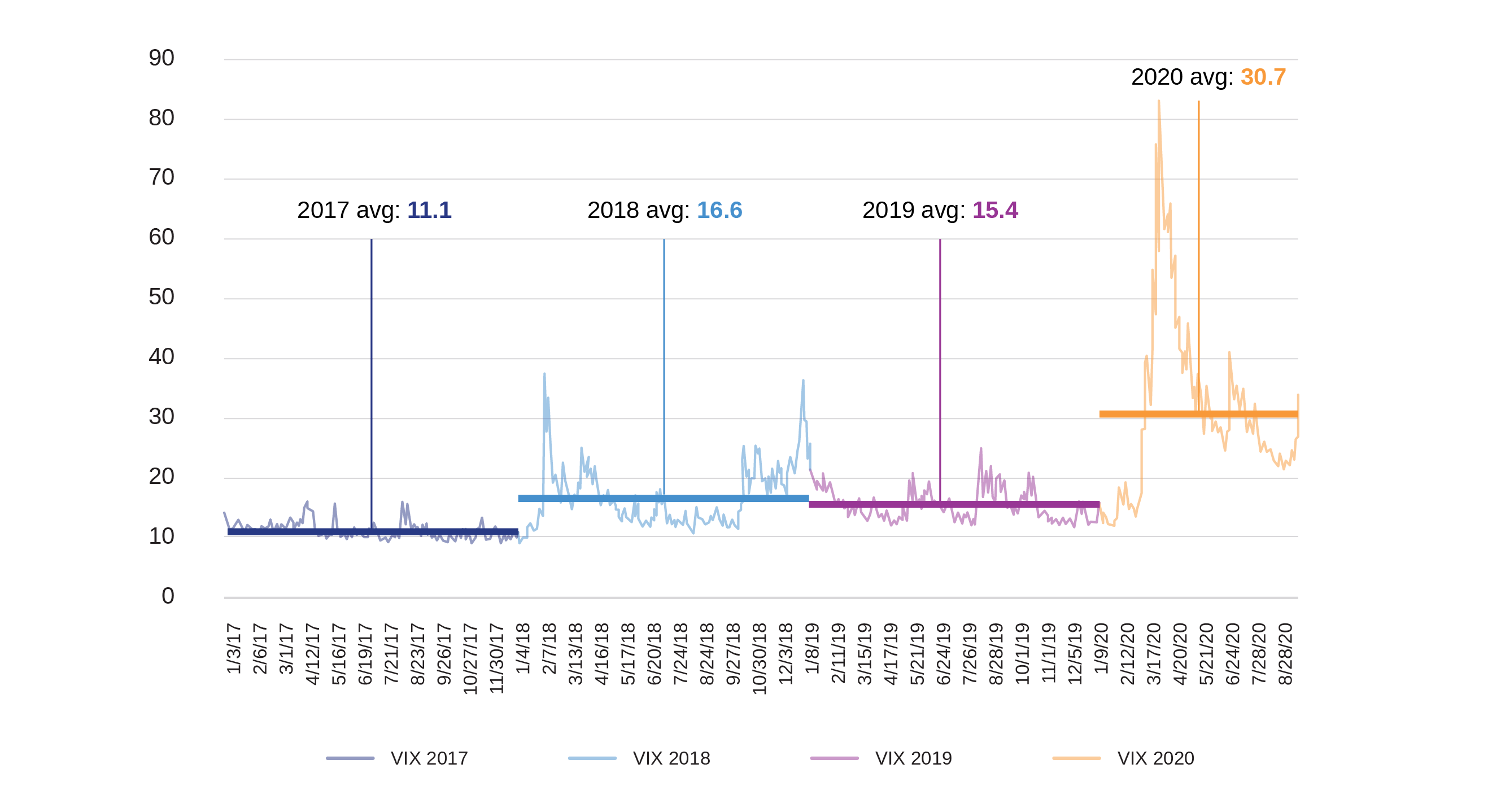

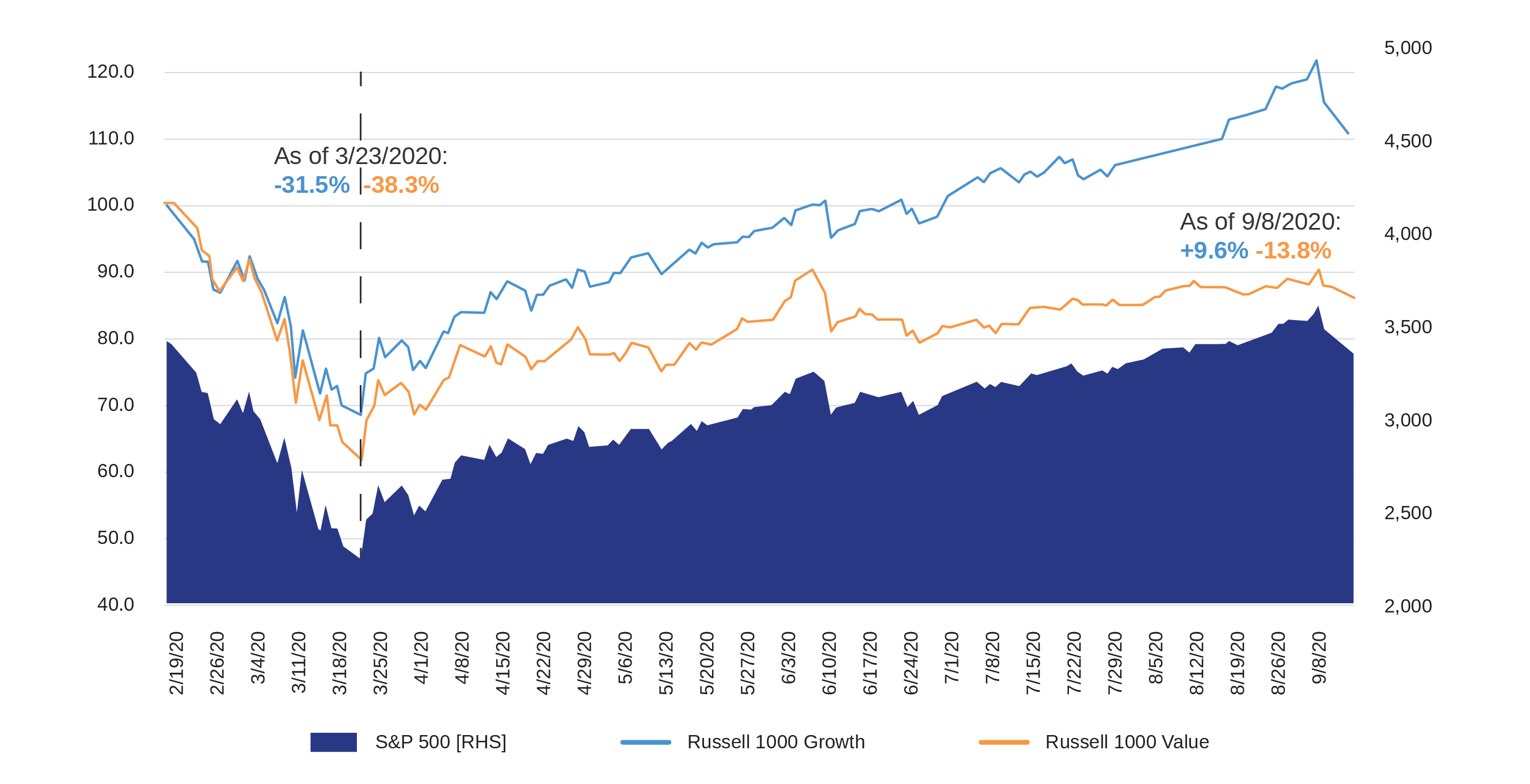

Volatility in the equity markets is ever-present, even if it may be hiding below the surface for some time. Investors do not need to be reminded of March 2020, where the Market Volatility Index (“VIX”) spiked to 82, coinciding with 31%, 38%, and 34% respective declines in the Russell 1000 Growth Index, Russell 1000 Value Index, and S&P 500 Index.

Chart 1: CBOE Volatility Index (“VIX”)  Source: FactSet

Source: FactSet

Recent volatility has hit the market over the past week, causing a pullback of 7% in the S&P 500, with growth companies getting punished more, down 10% in the same period. Even with the recent move over the past week, since the March 23rd bottom, equity markets have rebounded significantly, and we continue to see the theme of growth outperforming value.

Chart 2: Growth vs. Value Spread since Feb 19th Market Peak

Source: FactSet. Russell 1000 Growth and Russell 1000 Value Indexes shown as indexed at 100 as of Feb 19, 2020.

There have been a variety of opinions on the reason for the sell-off, ranging from Softbank buying options on large tech companies to retail traders buying $40 billion in calls, both actions possibly forcing the market upwards over the last month and in recent days causing an outsized pullback. These large options bets, combined with the shrinking of US actively managed assets, now dipping below a 50% share as passive assets continue to gain favor, have an outsized effect on day-to-day stock market volatility. With the increase in passively managed assets and increases in allocations to non-fundamentally managed strategies (e.g., ESG, Quantitative, Factor-Based, CTA strategies), we expect higher than historical daily volatility as more sellers and buyers make decisions irrespective of equity prices. This development calls for increased scrutiny and patience by investors to daily price moves. Our approach to this challenge is to deploy a fundamental, repeatable process that’s both patient and opportunistic during these large swings in prices.

Moving forward, we would not be surprised to see the last three months of 2020 play out similarly to the first nine months of the year, with continued above average volatility. This is exhibited by the VIX Index sitting around 30 currently, well above the last three-year average. The quantitative reasons listed above may indeed be the culprit behind positive or negative short-term volatility of late. Additional blame could also be placed on the variability in reopening efforts to the global economy post the initial lockdown, the market attempting to price in real-time the likelihood of vaccine and therapeutic failures/successes, and the U.S. election cycle.

With all that said, we continuously stress-test companies in our portfolio and reallocate as we see better opportunities, as exhibited by recent position changes within the Growth Equity portfolio. We believe these incremental enhancements will assist the overall portfolio in continuing its efforts to deliver attractive long-term relative and absolute value creation.

As always, if we can help you, a friend or client, please do not hesitate to contact us with any questions.