The following is an excerpt from our recently published SWS Growth Equity 3Q strategy update. For a copy of the complete document, please contact us.. In the full piece, we provide our take on how to think through various sources of political uncertainty as investors, in addition to assessing the strategic merits of our internally managed strategy for public growth-style equity.

We view our quarterly updates as accountability milestones. The main goal is for the embedded analysis to act as the ultimate arbiter on whether our premise remains valid while assessing our efforts to deliver results. Despite what feels like a year’s worth of market-impacting news squeezed into a single quarter—we take a stab at deciphering some of this later in our Market Perspective section—3Q2020 was accretive in both relative and absolute terms, and we remain optimistic on continuing our quest for sustainable alpha delivery. We also see strong odds that the output of these efforts could satisfy two important investor bases, the ever-discerning relative performance seekers and those more focused on absolute outcomes. The details behind this reveal that long-term capital is well served by focusing on the sources of disruptive innovation.

Investing through Uncertainty: Focus on Digital Enablers

First, a side note on persistent uncertainty. Attempting to see through the haze is core to what we do, and it will always be so when investing in public equity. Assessing today’s seemingly limitless slate of imperfect information, it’s becoming clearer that the thesis we identified back in May—better outcomes require being over-indexed to the digital enablers—continues to be a critical thematic overlay in navigating the current environment. It also suggests that we don’t require “all-clear” signals on the election, stimulus sizing/timing, or COVID therapeutics/vaccines in order to deliver attractive return results. It does require careful diagnosis of the root causes behind the current massive demand shifts and deciphering what’s sustainable versus transitory.

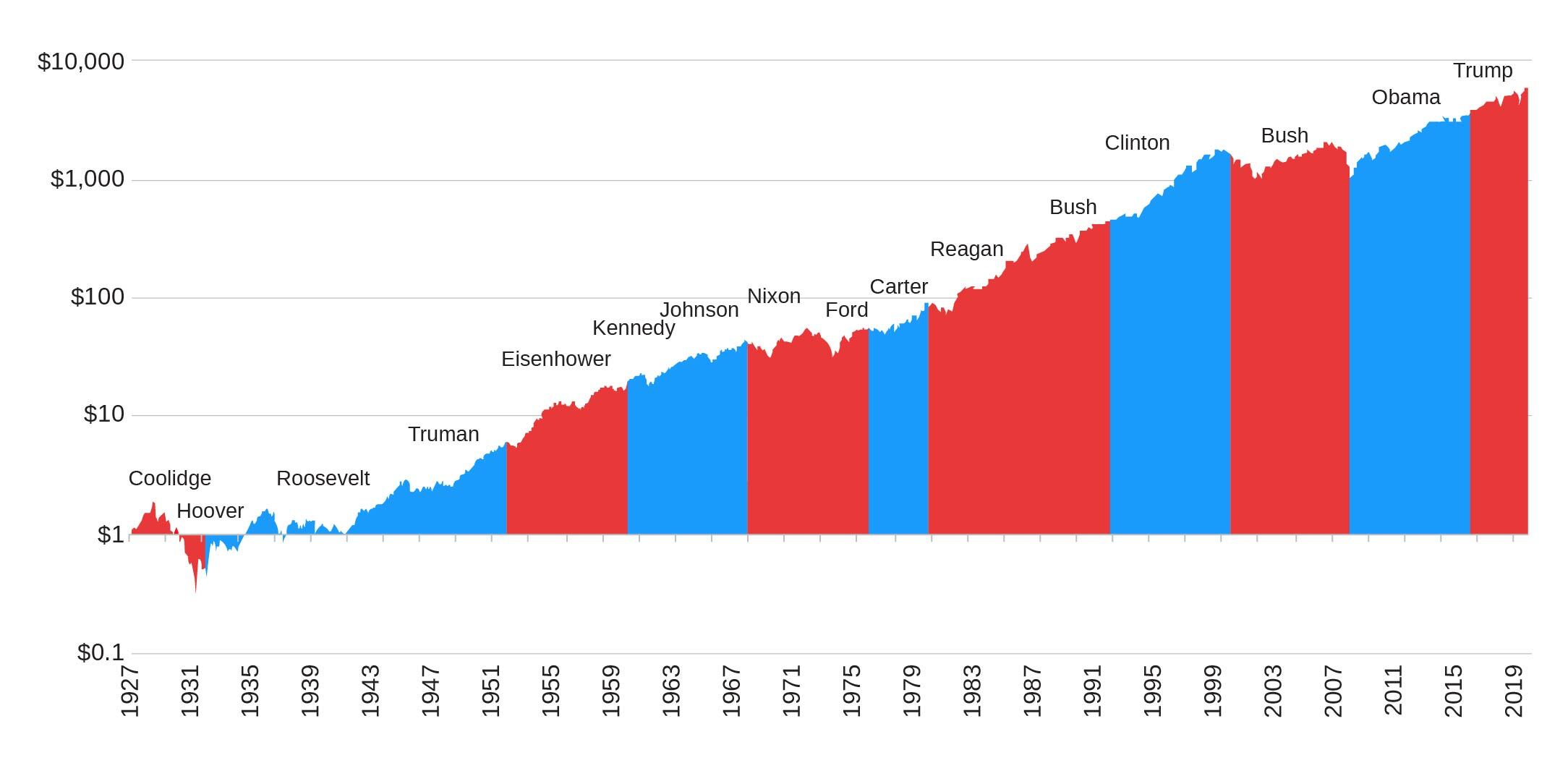

Growth of $1 since Coolidge

Source: S&P Global, FactSet

Source: S&P Global, FactSet

Investing amidst a backdrop of COVID exhaustion can make it easy to overlook how increasingly reliant shareholder value creation has become upon digitally-sourced innovation. We highlight evidence of this in Contributors & Detractors, but it provides a helpful reminder of why it’s imperative to make the identification of the source and directionality of disruptive innovation a core investment process tenet.

To receive a copy of our entire SWS Growth Equity quarterly update, please contact us.