The following is an excerpt from our recently published SWS Growth Equity 4Q strategy update. For a copy of the complete document, please contact us. In the full piece, we provide our take on thinking through various sources of macro uncertainty as investors, in addition to assessing the strategic merits of our internally managed strategy for public growth-style equity.

Coming off a recession-triggering year in the throws of a global health crisis creates a challenging backdrop for any market forecaster. In effort to chart our forward path, we find it helpful to borrow from our fundamental investment process, seeking simplicity among chaos. Here, we isolate our investment premise: exploiting the market’s inefficiency of pricing long-term competitive disruption, specifically that which is enabled by disruptive innovation. As we study the evidence that’s filtered through the macroeconomic noise, it’s clear that the global pandemic response accelerated many mis-pricings that we were readily poised to exploit in 2020. As we study the opportunity landscape going forward, we also see ample runway for attractive excess returns over the coming years.

A New Paradigm for Platform Proliferation

Historically, the phenomenon of disruptive innovation was neatly confined to pockets of concentrated sector investing. Any effort to gain exposure also required the complete abandonment of reasonable valuation methodologies. During the early days of the Internet, who needed cash flows when you had clicks and eyeballs? A major gating constraint turned out to be burdensome capex that sapped cash flow and eventual escape velocity, thanks to the price tag of proprietary data centers (long before multi-tenancy was a thing). However, what used to be a multi-million-dollar up-front capex hurdle can now be rented at sub-$0.01 a compute millisecond. This has in-turn ushered in an entirely new paradigm for platform proliferation.

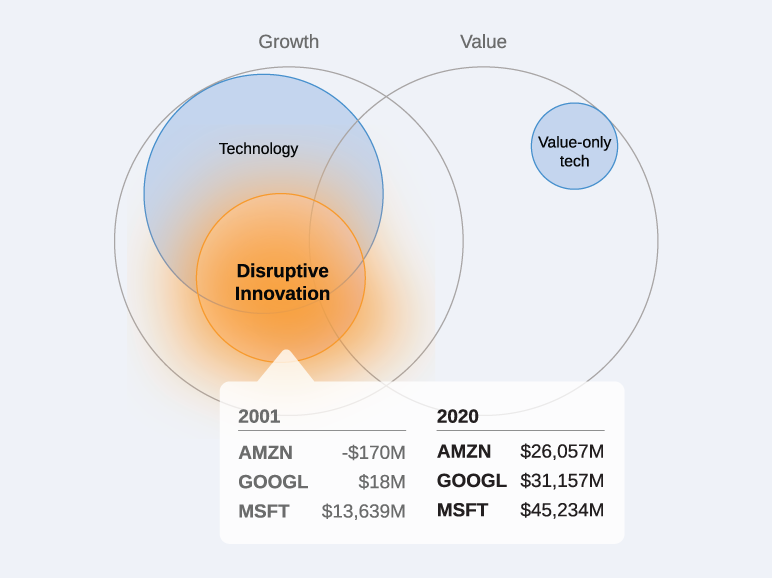

Figure 1: Our Take on Public Equity Addressable Opportunity

Source: SWS Partners, FactSet, FTSE Russell

Today, cloud platforms are revolutionizing digital disruptions across every segment of the market. The concept also has quickly become top priority across all corporate boardrooms. We are confident that in the final analysis, companies’ success or failure will increasingly be determined by their ability to harness the disruptive powers of innovation, all in the pursuit of attaining profitable market share. Our stab at sketching the current addressable opportunity among public equity can be found in Figure 1 above, with the free-cash-flow overlay acting as a reminder on the stark differences of tech then vs. now.

To receive a copy of our entire SWS Growth Equity quarterly update, please contact us.