The following is our view on how to navigate this week’s heavy political slate, which is an excerpt of our Growth Equity quarterly update.

Political risks are particularly challenging for investors, especially in economic areas where cash flows can be impacted by shifting political winds. Thanks to the fungibility of capital, we see opportunities for the main cylinders of our economic engine to continue to fire. The exercise just requires increased fundamental rigor.

The Market’s Dynamic Adjustments to Probability

The only thing certain about political uncertainty: it comes in many forms and can be tough to predict. The House subcommittee’s efforts are one aspect, while November moves us closer to solidifying compositions of both executive and legislative branches. Given that this particular exercise recurs on four- (presidential) and two-year (midterm) cycles, the market is no stranger to digesting, and seeing through, this newsflow. The market’s embedded probability-weighing mechanism will not wake up on November 4th and flip from 0% to 100% should the underdog win; probabilities shift daily in one way or the other with prices adjusting in anticipation of the changing outcomes.The Administration’s Impact on the Market

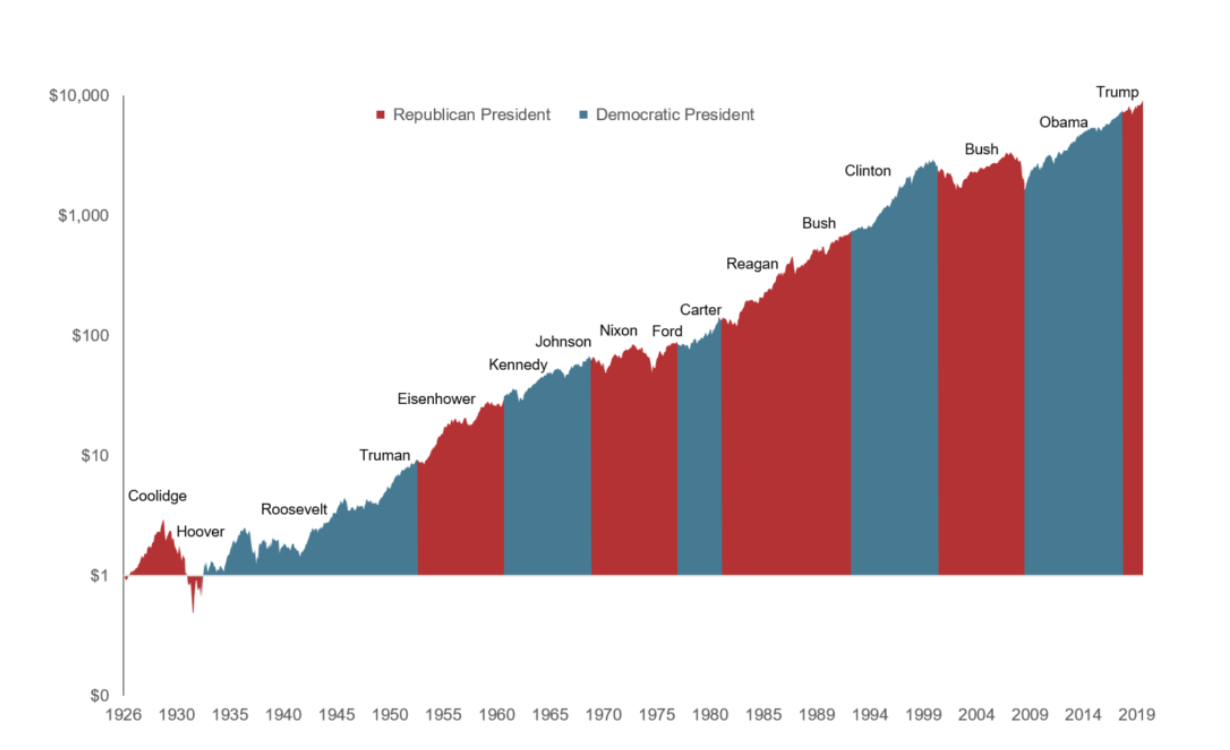

It’s easy to fall down a rabbit hole when attempting to assess which political outcomes are more market-friendly. We see strong odds that executive leadership of US businesses will continue to deploy their fungible capital towards attractive returning pursuits. The economy in turn will grind forward regardless of party composition in Washington. Chart 1 below acts as an elegant reminder of how this dynamic has unfolded—and likely will unfold—across decades of shifting political winds:

Chart 1: Growth of $1 Since Coolidge

Above represents growth of $1 invested in the S&P 500 Index since 1928 including dividend reinvestment. Source: S&P Global, FactSet

Above represents growth of $1 invested in the S&P 500 Index since 1928 including dividend reinvestment. Source: S&P Global, FactSet

A Lesser Unknown Challenger

We also see some factors translating into decreased uncertainty in the current cycle. Presidential challengers tend to be more of a wildcard relative to incumbents due to lesser-known governance histories. The 2020 Democrat card mitigates many of these factors, given Biden’s vice presidential history. On the healthcare front, a full-Obamacare reinstatement would entail dusting off the marketplace implementation playbook, with the possibility to avoid system crashes that plagued 2013’s implementation. Federal budget dollars would undoubtedly shift, causing sources of funds from the prior four years to turn to possible beneficiaries. This might put outlays to defense in the cross-hairs, while education, healthcare, and environmental affairs could be net benefactors.

Federal Taxation Efforts Over the Decades

On the tax front, there would, undoubtedly, be increased efforts to extract more from corporate coffers and from high-income individual earners. Although a corporate rate hike directionally would cause us to slip down the ranks of being globally competitive, a pro-forma 28% rate leaves us in better relative territory than the 35% level of 1993-2016 and all prior periods going back to the 1940s. Since capital has a way of migrating away from harsh regimes to more favorable ones, we see it likely that federal tax receipts will continue their path of fluctuating around an equilibrium, when viewed in the context of domestic GDP. Chart 2 below shows how this relationship has held rather consistently in the post-WWII era (blue line) despite massive changes to individual income tax brackets (yellow dotted line).

Chart 2: Federal Tax Receipts in Relative Context

Source: Tax Policy Center, Urban Institute and Brookings Institution; US Bureau of Economic Analysis; FactSet.

Source: Tax Policy Center, Urban Institute and Brookings Institution; US Bureau of Economic Analysis; FactSet.

The Bar Is Always Rising

The bar for public equity investors to ingest information is always being raised. Setting all current macro factors on the scale, we see enough visibility for economic value creation to continue, which should bode well for equity market appreciation. Retaining consummate adaptability at our core will continue to prove essential, along with the need to identify and leverage all aspects of our increasingly digital futures. This will likely translate into more front-end work behind idea generation, but these are the exact conditions in which our investment process is built to thrive.

To receive a copy of our entire SWS Growth Equity quarterly update, please contact us.