In Parts 1 and 2 of our Venture Capital Investing for Private Investors series, we discussed how technology has enabled more investors to harness the growth potential of private companies and the macro backdrop related to investing in these types of companies. Here, we will share why size matters for private deals.

…

According to PitchBook, the median venture fund size jumped 64% from 2017 values to $82.0 million, demonstrating the fundamental shift toward larger venture funds across all stages. By year-end, there were 11 funds raised with more than $1 billion in commitments, up from just three funds last year and representing a decade-high.

According to PitchBook, the median venture fund size jumped 64% from 2017 values to $82.0 million, demonstrating the fundamental shift toward larger venture funds across all stages. By year-end, there were 11 funds raised with more than $1 billion in commitments, up from just three funds last year and representing a decade-high.

This “size-factor” potentially introduces an element of risk for investors.

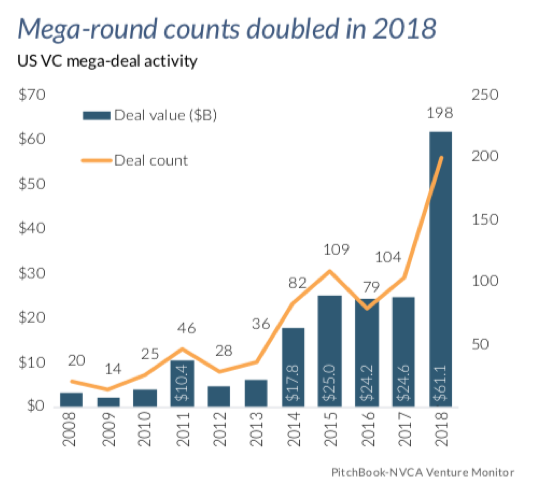

As with mutual funds or exchange-traded funds, size matters. More specifically, as a product grows in size, there is often a performance penalty. So, with the size of the deals increasing at traditional venture firms, you may see an erosion in net returns. For example, in Q2 of 2019 technology investments saw a $1.31 billion decline relative to Q1 due to the impact of the large-dollar nature of late-stage PE deals that can swing the overall numbers. That said, late-stage venture and technology growth is where U.S. and Canadian startups are gaining ground relative to international ventures.

SWS Partners tends to traffic in earlier stage deals brought to us by our network of clients, advisors, and consultants, and we think this is a sweet spot with greater upside potential than the mega-deals that the big shops are emphasizing. The caveat, of course, is making sure there has been a thorough due diligence process and that the deal is appropriate for the investor. Venture is a game of risk capital, so loss is always an option. With the most common exit being via merger or acquisition, followed closely by an initial public offering, length of time of the investment must also be considered.

As it relates to SWS Partners’ due diligence process, we have been able to systematize much of our research and due diligence by leveraging partners like AngelList and a comprehensive network of founders, institutional investors, and advisors. AngelList is a noteworthy partner, having funded 1,133 startups sourced from 255 angels in 2018 alone. Therefore, we can bring to our clients a broad cross section of vetted early stage deals.

Ultimately, we believe that venture capital is an asset class that private investors should be accessing as a way to harness potential growth opportunities and to diversify away from public markets. It is also a way to philosophically invest in the next generation of founders and iconic companies. But as with other investments, there is a great deal of nuance and idiosyncratic risk that must be accounted for. If you’d like to learn more about us or our process, we’d be happy to talk to you.